What if we cut out the middleman and instead sent 60% of all taxes straight to the provincial governments responsible for delivering health, education, and social services? Ottawa, in turn, would be able to end most transfer programs to the provinces along with all the strings, bureaucracy and waste attached to them.

Quebec has already proposed having the federal government let provinces keep GST revenue generated in their provinces in return for ending the federal health transfer.

Less money collected and wasted in Ottawa. Less federal transfers with only a modest amount of equalization for the smallest provinces and territories that actually need it. And more funds for provincial health, education and other programs without strings attached by Ottawa’s politicians and bureaucrats.

That seems like something most provinces could rally behind.

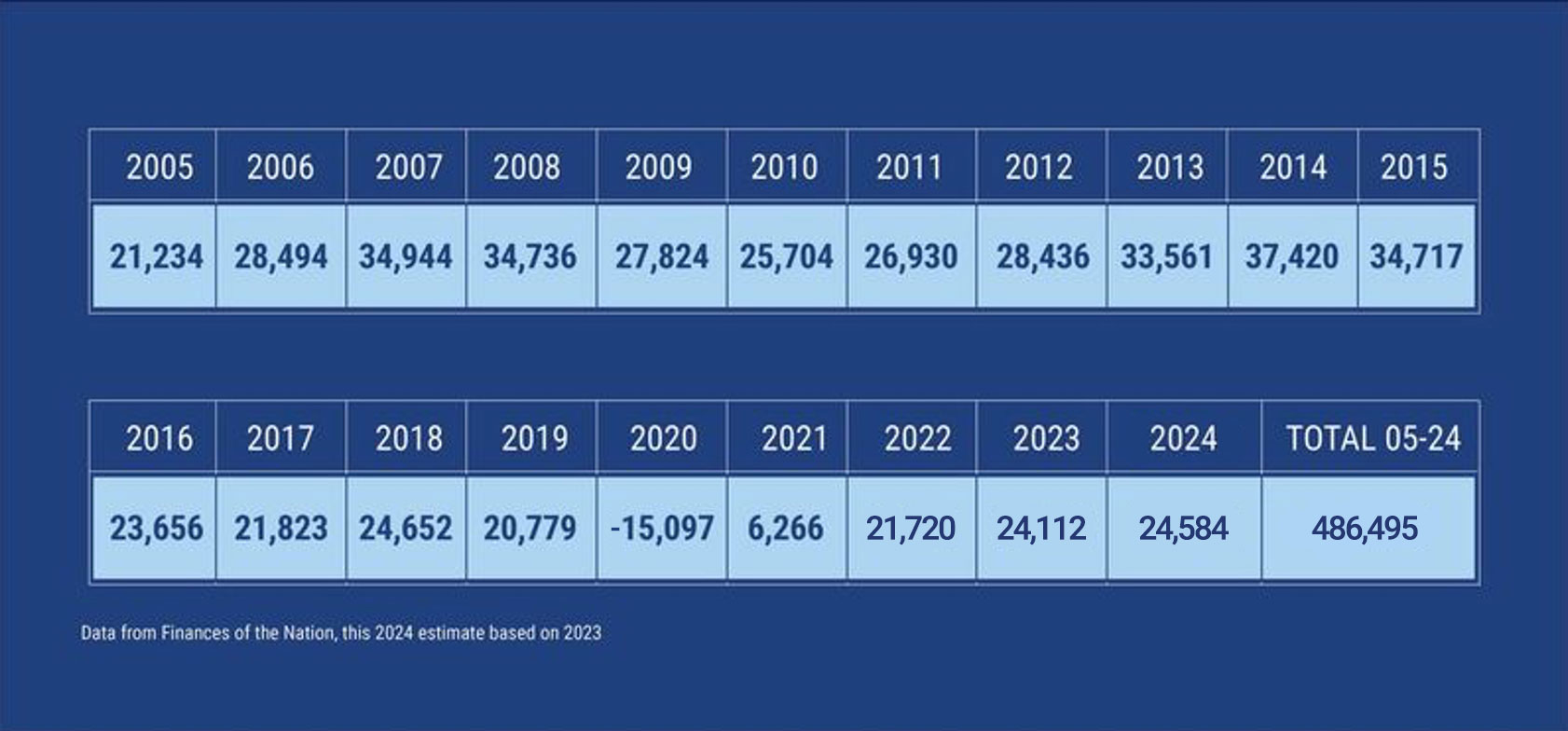

Albertans’ annual net contribution to Canada has averaged over $23 billion over the last 20 years.

That’s roughly $20,000 per family of four, yearly.

In those 20 years, $486 billion was taxed from Albertans and spent elsewhere (2022 dollars).

That’s not a cheque written by the Legislature. That’s the difference between what Albertans paid in federal taxes and what Ottawa sent back to Alberta in benefits, transfers, and other spending.

Some of that total, of course, is legitimate federal spending like the military, borders, and interprovincial infrastructure. Higher income regions will always pay disproportionately more taxes – still, even with our military bases, national parks, and vast highway system, Alberta gets a low proportion of federal dollars spent back here.

For legitimate federal spending Albertans are willing to pay our share. But at least half of the dollars Ottawa taxes are used for spending or regulating in provincial areas. Whether it is health, social services, housing, post-secondary education, policing, infrastructure, economic development, or energy policy - these are all entirely or predominantly provincial jurisdiction.

Not only do these dollars get disproportionately spent in the eastern part of the country, the portion that does come back has strings attached from a second layer of federal bureaucracy (that gets paid first).

Provincial areas are where most of the spending, and spending pressures, are. So why do Canadians send so much more of their taxes to Ottawa than to the provincial government delivering these services?

All Premiers have agreed that Ottawa is too involved in provincial jurisdiction. Four premiers have called for Equalization reform, but that’s just a part of the picture. ($3 billion of the $23 billion we subsidize Ottawa with goes towards Equalization.)

We need to unite as provinces and tell Ottawa to take a big step back so we have autonomy and accountability over provincial jurisdiction. The question is how we think fiscal federalism should work.

The federal government would end many of its transfers and other programs that violate provincial jurisdiction, then cut federal tax rates by that amount. Provinces would fill that tax room and not have to count on Ottawa for provincial funding.

There is only one taxpayer. Given that Albertans pay more taxes per person, even when we get the average back from Ottawa we have lost dollars that could stay in Alberta to support our services.

There are some shared areas of jurisdiction, but in general, our constitution says no.

Whenever Ottawa comes in to help with funding something, there are one-size-fits-all strings attached, added bureaucracy, and no assurance they will maintain the funding. Autonomy in service delivery means we can tailor our spending to our priorities and plan better for the future. Different provinces trying different approaches is a good thing.

There is a good reason our constitution set out so many areas as provincial.

Equalization is a principle affirmed there in 1982, but the requirements are fairly vague and the formula is not defined.

Currently, the program is bloated and flawed. Its payments grow with GDP regardless of how equal the provinces are. The payments are so large that in most years billions are sent to recipients even after they have reached the national average. Ontario now gets a payment because the “have nots” are getting pushed above it!

Equalization contributes to the subsidy problem Albertans face, but if most of the indirect forms of interference and redistribution were fixed then a reformed, transparent equalization formula could be broadly supported.

One issue B.C. and Newfoundland have identified is large provinces like Ontario and Quebec getting subsidized by small provinces through equalization. One solution that has been proposed is that the four largest economies should not be directly subsidizing each other via Ottawa. Quebec currently has lower productivity than the other three, but should the second largest economy in Canada be getting a $13 billion cheque every year? For equalization, after the smaller provinces are brought close to the national average, a reformed formula could see the four large provinces share in the rest of the budgeted amount evenly, or not spent at all.

Yes. The Fiscal Stabilization program is meant to give a one-year boost to stabilize finances when a province has a sudden drop in revenues. When Alberta’s revenues dropped $8 billion in 2015 our “stabilization” payment was $0.25 billion. Albertans routinely provide $5,000 per capita to stabilize federal revenues, but when we were in need Ottawa’s help was capped at $60 per person.

Provinces unanimously agreed five years ago that the cap should be lifted, and that Alberta should get a retroactive payment for 2015 and 2016. The Feds ignored the retroactive payment and only raised the cap to $172 per person.